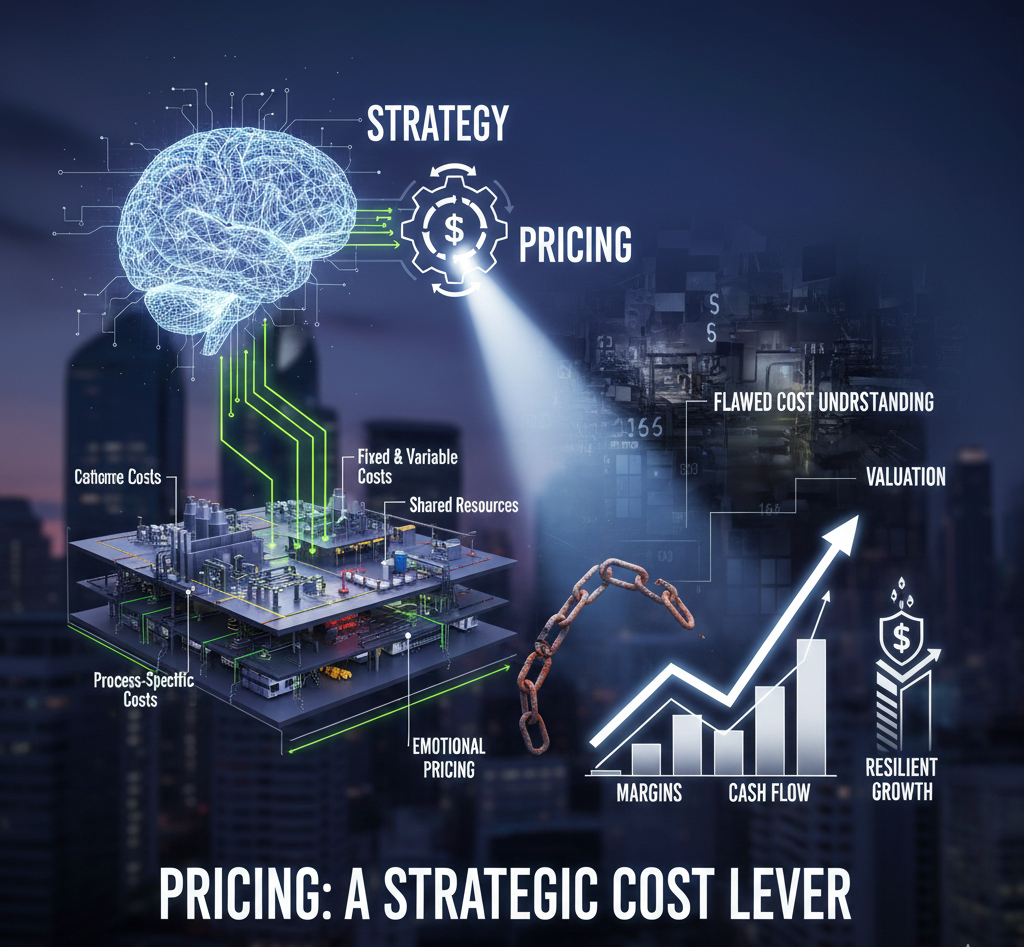

The Price of a Product: Why Cost Is the Most Overlooked Strategic Lever

Pricing is often treated as a simple arithmetic exercise.

Add a margin over cost. Match the market price. Adjust when pressure shows up.

For years, many businesses, especially MSMEs, have operated this way. But those days are long gone. In today’s environment, pricing is not a formula. It is a strategic decision. And at the heart of that strategy lies the most neglected element: cost.

Most companies still rely on a basic cost structure, material, labour and administrative overheads. While this may appear straightforward, it is also where the largest margin of error creeps in. A misallocated cost today can distort pricing tomorrow. Over time, this distortion quietly erodes competitiveness, profitability and even survival.

The problem is not intent. It is visibility.

When cost structures are simplistic, pricing decisions are built on assumptions rather than economic reality.

As businesses scale, complexity increases. Shared resources expand. Capacity utilisation fluctuates. Fixed and variable costs blur. Overheads hide inside processes that no longer get questioned.

Yet pricing decisions continue to rely on outdated cost logic.

This creates a dangerous gap.

Leaders believe they are protecting margins, but in reality:

• Costs are absorbed unevenly across products

• High-performing lines subsidise inefficient ones

• Price sensitivity is misread

• Discounts are offered without understanding true impact

What looks like a pricing problem is often a costing problem.

Modern businesses have moved toward strategic costing or strategic cost management. This is a bidirectional discipline that works both ground-up and top-down.

The question shifts from:

“What does it cost to make this product?”

To:

“How should cost be allocated to reflect the true economic reality of producing, selling and sustaining this product?”

This requires leaders to examine:

• Fixed and variable cost behaviour

• Capacity utilisation and idle cost

• Shared services and hidden overheads

• Process inefficiencies embedded over time

• The relationship between cost, value and customer willingness to pay

Strategic costing does not reduce cost blindly. It clarifies cost intelligently.

When cost is understood correctly:

• Pricing decisions align with long-term competitiveness

• Margins reflect strategy, not hope

• Growth strengthens financial health

• Leaders move from reaction to intent

Cost stops being an accounting exercise. It becomes a strategic lever.